Convert PDF to OFX

Need to import bank or credit card statements into Xero, FreeAgent, Sage, Quickbooks Online, ZARMoney, Microsoft Money, or other accounting software but cannot seem to make it work? When your bank provides PDFs only, and the accounting software you use supports OFX file format only, you cannot load statements directly.

The Solution: Try the ProperConvert (PDF to OFX converter) app. The software makes it easier than ever to convert files from PDF to OFX and offers seamless document conversion, enabling you to transform your documents into the desired type effortlessly.

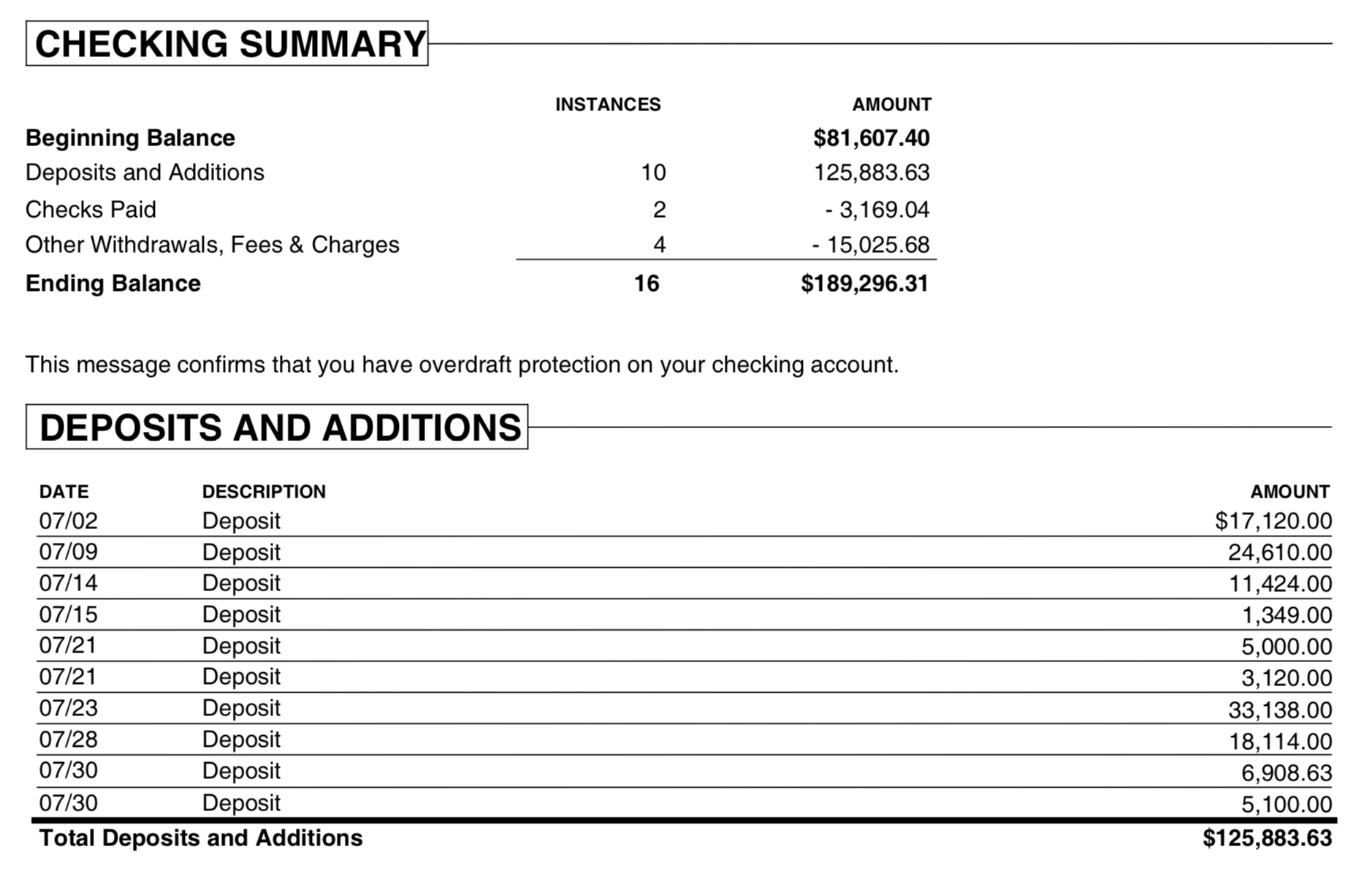

PDF (Portable Document Format) is widely used for documents shared and viewed on various devices and platforms. PDFs are designed to be shared and maintain a consistent appearance regardless of where they are viewed, whether on paper, on screen, or across different operating systems. This uniformity ensures that documents look exactly the same no matter how they are accessed. However, from a records perspective, PDFs can be particularly challenging to work with, especially when dealing with bank and credit card statements. These statements often contain transaction tables mixed with other text, such as headers, footers, and disclaimers, which can interfere with the actual transactions. This mixture makes it difficult to extract and manipulate the information accurately.

OFX (Open Financial Exchange) documents are commonly used to import data into accounting software due to their standardized and structured way. Unlike PDFs, OFX is the file type specifically designed to facilitate the exchange of financial records and can be easily imported accurately by accounting software. The use of OFX streamlines the process of reconciling bank and credit card statements, reducing the risk of errors and saving users time. By providing a reliable and efficient way to transfer financial information, OFX files help ensure that accounting records are up-to-date and accurate, which is crucial for effective financial management.

The ProperConvert lets you quickly convert your PDF bank statements into various accounting formats, including OFX, simplifying your financial record-keeping process.

Convert transaction from PDF to OFX format

Introducing ProperConvert(replaced legacy PDF2OFX) app.

- Easily extract transactions from PDF files and create OFX that is ready to import into your accounting or personal finance software or online service.

- Avoid a manual entry for the data you already have in bank or credit card transaction format and process data quickly.

- Use bank and credit card statements with various layouts. Extract data from columns like date, amount, and description, and check the number of your transactions. Converting your banking transactions into OFX files could not be easier. All your transactions will be converted to the OFX format with just a few clicks.

- Try a free trial, and do not hesitate to contact us for support before and after your order.

- Convert your and your clients' banking documents on your computer without uploading them to the cloud

- You can work with your transactions in the converter or extract them to CSV and then use CSV converter option to OFX. You may find the best workflow option for your bookkeeping process.

- Convert an incompatible statement format, such as PDF, to a different format OFX that is compatible with accounting software.

- Import transactions from image, scan, or simple text PDF versions: extract data from text-based, image, or scanned PDF files.

How do you convert from PDF to OFX using the converter tool?

Follow the easy steps below to convert.

- Begin by downloading, installing, and launching the converter software from the download page.

- Choose a PDF bank file and open it within the software.

- Review extracted transactions to ensure accuracy.

- You should back up your accounting software data before you load any files.

- Click the Convert button to convert to a new OFX file. If you want to work with the CSV first, choose the CSV option instead of OFX. Later, open the final CSV in the app instead of the PDF file

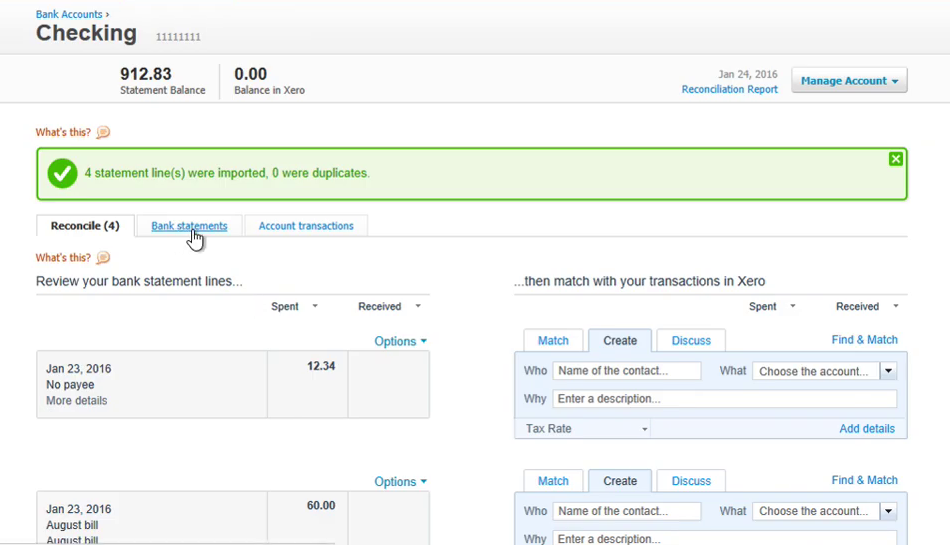

- Import created OFX files into accounting software like Xero, FreeAgent, QuickBooks Online, ZARMoney, YNAB, Sage 50/300, AccountEdge, Microsoft Money, and others.

Can I edit transactions before converting?

You can edit transactions as they are extracted from a PDF file. The current converter version provides basic editing and, for the most efficient work, converts to CSV format first, opens the CSV file in spreadsheet software, edits, saves, and then converts the file as finalized CSV Excel to OFX.

Can the transaction table be accessed in a PDF without converting it?

Copy data as plain text from a PDF file opened in Adobe Acrobat and paste it into your accounting software data entry form. However, this method may be more time-consuming than the ProperConvert app. By utilizing the pdf-to-CSV converter function, you can easily convert your files to CSV files for more efficient data extraction and conversion to OFX.

Can tabular transaction data be extracted using a generic PDF tool?

Some generic PDF tools, including those available free online file converters, can export data to CSV format. However, using these tools often includes additional information from the PDF, such as account headers, interest tables, and other details that are not related to transactions. Consequently, you might need to clean up the resulting CSV file. This could involve correcting date and amount columns that may be formatted incorrectly. For instance, dates in the PDF might be listed in a short format like "May 3," which would need to be converted to a more complete format with the year included.

If you want to convert your files quickly and accurately, our software provides the easiest-to-use solution.

Is the conversion program suitable for multiple users?

Absolutely, the app can be installed on several computers and accessed by various users. Users may utilize multiple windows at the same time. We provide licensing options to accommodate multiple users.

Is there a free converter version?

You may use a free trial to test the parsing without limitations for files from a bank and convert up to 10 transactions into an output file.

Is there an option for using the online converter version?

The converter converts files on your Windows or macOS desktop.

Is it easy to import OFX files into accounting software?

All modern accounting apps import OFX, providing a comprehensive interface for importing OFX, reviewing details, assigning vendor records and expense and income accounts, and saving to the register.